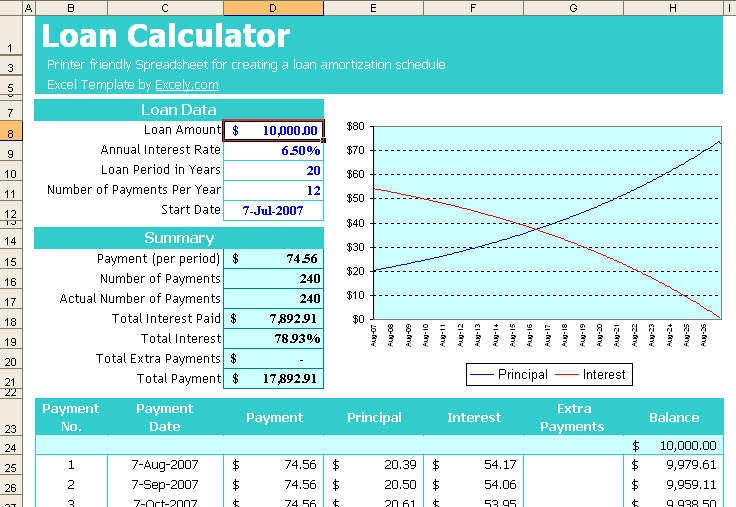

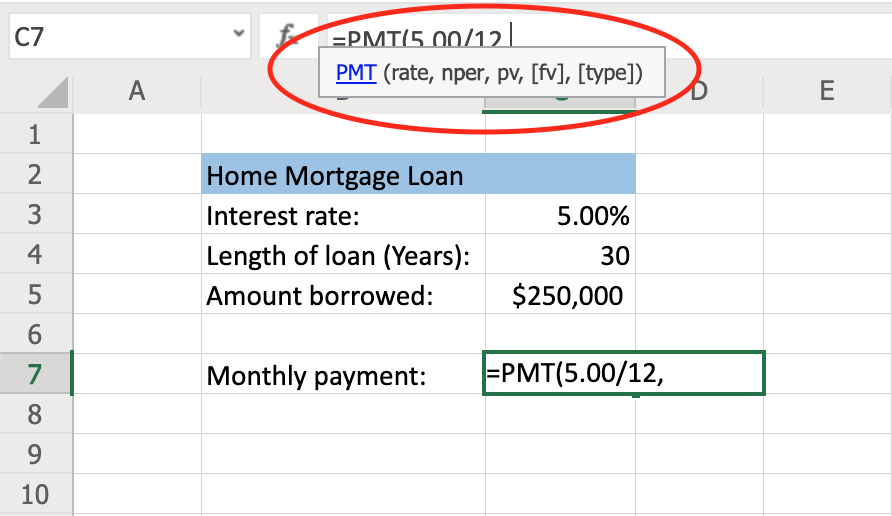

The calculation of EMI, Principal repayment and Interest involved in each EMI is shown in the below figure:Īs we can see that EMI will remain the same and with each repayment of monthly installment, Outstanding Loan Amount will also reduce and will become zero at the end of loan term. His Interest payment for each period will reduce and correspondingly principal repayment will increase gradually, resulting in full payment of loan amount, along with interest at the end of 12 months. EMI = /īy using the formula, we come to know that Ram has to pay an EMI of Rs.1776.98 for 12 months.Alternatively, we can also calculate the EMI and Interest using the formula, So, EMI and Interest amount can be calculated in Excel using PMT Function. The terms of the loan are as follows:Ĭalculate the EMI and Interest amount per period. Ram purchased a Mobile of Rs.20000 from an outlet at a loan.

Simple Interest Rate Formula – Example #2 Total Obligation (Repayment Amount) = Principal + Interest.So, Interest Amount using simple interest rate formula will be: Let us understand this formula with the help of some examples. To calculate Simple Interest, we need the Amount Borrowed along with the period for which it has been borrowed and the Rate of Interest.Įxamples of Simple Interest Rate Formula (With Excel Template) In this case, Interest is not calculated on Interest Amount accruing on the loan amount, likewise in the case of the Compound Interest Formula.

In the case of Simple Interest, Interest is calculated on the Loan amount, which is also termed as Principal Amount of loan. Simple Interest Formula is one of the easiest ways of calculating interest on Short term Loans and Advances and Term Loans. In this article, we will discuss Simple Interest.

Interest can be of different types like Simple Interest, Compound Interest, Effective Interest, Annual Yield etc. Start Your Free Investment Banking Courseĭownload Corporate Valuation, Investment Banking, Accounting, CFA Calculator & others

0 kommentar(er)

0 kommentar(er)